In today’s competitive business world, Return on Investment (ROI) is simply the way we measure whether the money, time, or resources you put into something are actually paying off. Think of it as asking: “For every dollar I spend, how much do I get back?”.

A high ROI means your strategy is working hard for you, while a low ROI is a red flag that it might be time to rethink your approach. Whether you’re an entrepreneur testing new ideas, a marketer running campaigns, or a corporate executive making big decisions, mastering ROI is like having a scoreboard that shows if your efforts are truly moving the needle toward growth.

What is ROI and why does It matter?

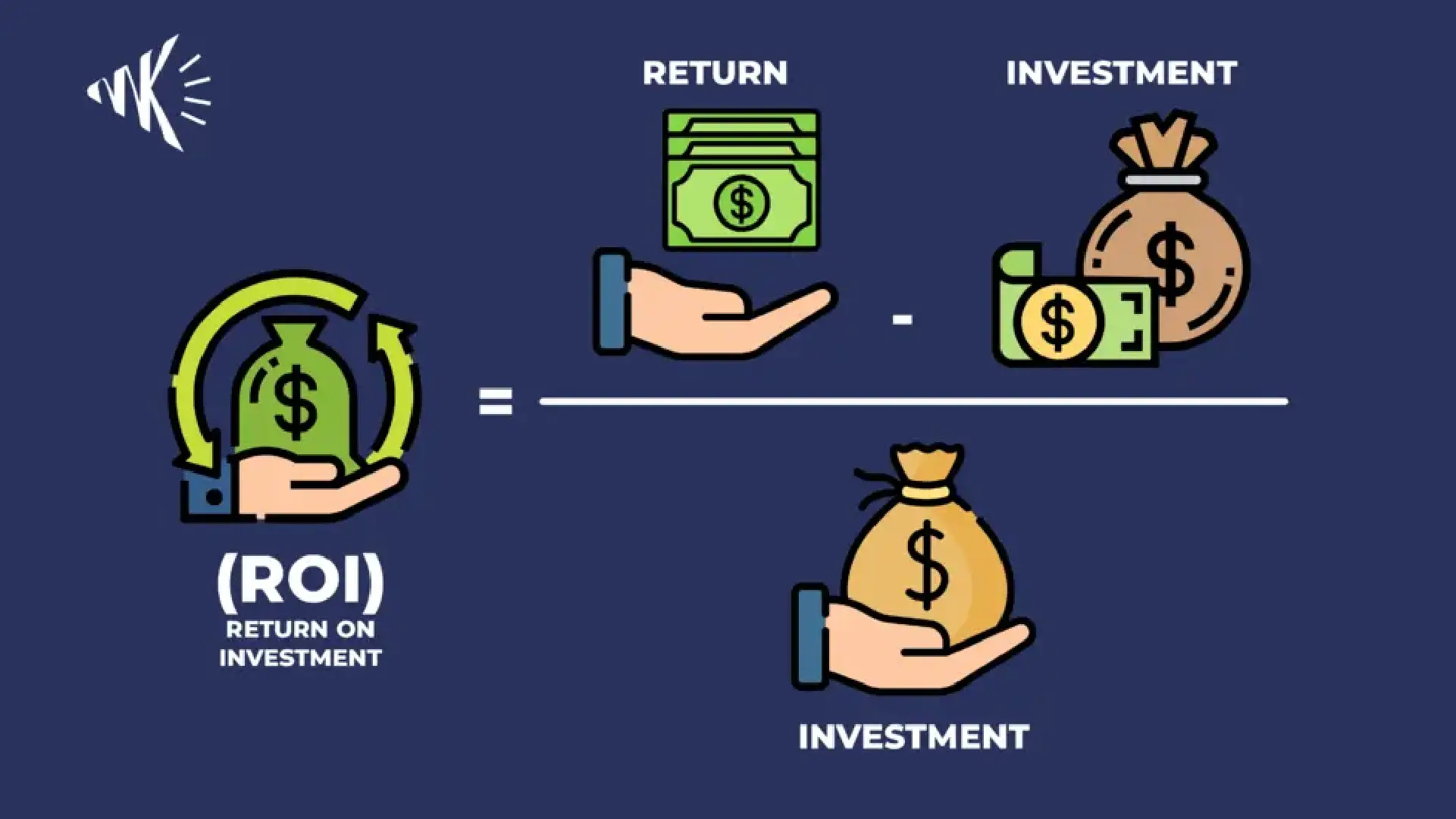

Return on Investment (ROI) is a key financial metric that helps you gauge how much profit an investment brings in compared to what you initially put in. To calculate it, you take the net profit from your investment, divide that by the total investment cost, and then multiply by 100 to get a percentage.

The return on investment formula is straightforward, but the idea behind it is powerful: ROI = (Net Profit / Investment Cost) x 100.

Knowing your own ROI is vital because it gives you insight into your investments and shows how much you’re earning relative to your contributions. For businesses, a strong ROI means better resource allocation, which leads to smarter decision-making.

How to calculate ROI in different contexts

1. Marketing Campaigns

Think of Marketing ROI as a way to see if your advertising dollars are actually bringing in the cash. In the real world, are your ads, SEO efforts, and social media strategies really making you money?

According to SEMrush, it’s crucial to evaluate how much you’re earning from content marketing versus what you’re investing to determine if your campaigns are on target. The calculation is pretty simple:

Marketing ROI = (Campaign Revenue – Campaign Cost) ÷ Campaign Cost × 100.

For example, if you spend $1,000 on a campaign that brings in $5,000, you’re looking at a fantastic 400% ROI! A high ROI indicates you’re making the most of your investments, while a low ROI suggests it might be time to change your approach.

2. Technology Investments

When you’re thinking about dropping cash on new tech, ROI is like your financial buddy, telling you if it’s worth it or just a money pit. Consider productivity gains, cost savings, and additional revenue potential. HubSpot’s numbers show that 8 out of 10 users got more done with their platform, and 7 out of 10 companies saw their revenue go up, proving that tech investments really pay off in the real world.

To evaluate such investments, look at factors like reduced manual work, improved marketing and sales results, and long-term operational gains, not just the sticker price.

3. Employee Training Programs

Employee training shouldn’t be treated as just another expense: it’s an investment in productivity and quality.

Measuring Training ROI lets you figure out how much your training programs are worth by looking at better performance and business results. The ROI formula commonly used is:

Training ROI = (money saved – money spent on training) ÷ money spent on training × 100.

So, let’s say you spend $10,000 to train someone and you see a $50,000 increase in productivity, that gives you a 400% ROI. According to AIHR, this measure goes beyond employee satisfaction and measures value to the business in the form of growth (sales), quality of the output, or some other relevant metric.

ROI business planning

When putting together a business plan, return on investment (ROI) is basically your evidence that the money you’re pouring into your idea can pay off with big returns. It’s essentially a reality check for investors and partners that they’re not only interested in your plans but also in how much each dollar that they put into your business will get them back.

ROI is sically a way way to show if the money you invested is worth the money you got back via this formula:

(Profit – Investment) / Investment x 100.

You invested $10,000 into a new idea or venture, it earned you $25,000, your return on investment (ROI) is 150%. When creating a business plan, this is the most important thing to highlight, how much money you could make.

Proving your ROI shows that you’ve done the work, gives investors confidence in your plan, and demonstrates that you’re worth the investment.

Key strategies to improve ROI

1. Set Clear Objectives

2. Optimize Cost Efficiency

To improve return on investment (ROI), it is important to reduce costs, where possible. Regularly perform audits on behavior across the business. its operations, logistics (supply chain), vendor agreements etc.

To determine where savings can be made. Continuing this practice encourages not only cost reductions, but overall efficiencies to free up resources toward projects and initiatives that drive growth and profitability.

3. Leverage Data Analytics

4. Prioritize High-Impact Investments

In order to grow and drive profitability, it is critical to identify the kinds of initiatives that will show the biggest potential-based returns, and then focus on them accordingly. By allocating resources and activities into initiatives that have the greatest impact, organizations can focus their efficiencies and maximize the returns on their investments.

Taking this strategic approach will allow organizations to best realize financial success and long-term sustainability.

FAQs

1. What is a good ROI?

A “good” ROI varies across industries and contexts. However, as a general benchmark, an ROI exceeding 15-20% is considered strong. It’s important to compare ROI against industry standards and historical data for meaningful insights.

For that we recommend that you clarify all your doubts with the experts at MoreKeting, the agency that adjusts any strategy to your needs and fixes any inconvenience that you are told cannot be fixed.